One of friend asked this interesting question about REIT. Why to buy REIT shares and not directly buy commercial properties? Because of the following Reasons:

- * Less Capital Intensive: Direct investment in real estate property is very capital intensive. But each shares of REITs will be comparatively more affordable (it will not require large capital outflows).

- * Suitable for small Investors: Moreover, buying property directly exposes common men to the POWERFUL BUILDERS. Investing through REITs will eliminate dealing with builders altogether.

- * Transparency: REITs stocks are listed in stock market. Hence all relevant details will all be available online for its investors.

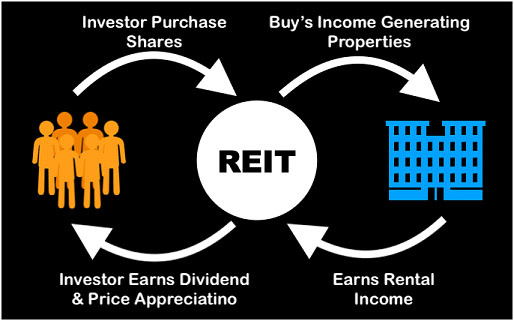

- * Assured Dividends: REITs generates income in form of dividend. REITs dividend payment is relatively assured. Why? Because most of their income is in the form of rental (lease) income.

- * Tax Free: Dividend earned by the investors of REIT will be tax free.

- * Fast Capital Appreciation: As Embassy REIT is first of its kind in India, its capital appreciation in next 5/7 years can be phenomenal.

- * Easy to buy: REITS will also easy the whole process of investing in Real Estate Properties, how?

Imagine yourself buying a property for investing purpose? What steps one has to take while investing?

- * Identify a good property,

- * book a property,

- * make self-contribution,

- * arrange for balance funds (if loan is required),

- * prepare a sale deed,

- * registration of sale deed,

- * taking of handover from present owner/builder,

- * maintenance of property etc.

But buying REITs (instead of directly a property) will eliminate all these steps. REIT is also regulated by a regulator which will further eliminate the chances of any bungling commonly done by substandard-builders.

Again, properties developed by quality builders are expensive and are generally out of reach of common men. But REITs will clear this hurdle.

Investment in real estate market through REITs will give the accessibility to common, to invest in properties developed by the quality builders.

Example: Had EMBASSY REIT not introduced in India, how many of us could have purchased an office space of such high quality? I hope you are getting my point.